Before landlords assemble a security put, it’s required to look at the condition’s local occupant and property owner regulations. Some states reduce count a property manager can charge to have a good protection deposit, while most other claims wear’t set limitations. In addition to, the quantity would be limited in line with the age the fresh occupant. On this page, we’ll go over everything you landlords would like to know from the defense places. 1 / 2 of questionnaire respondents paid back the protection put to the newest assets government team, plus one 31 per cent did so from assets government site. The company produces currency by billing tenants with the cost plan an enrollment fee during the sign-up—usually ranging from $20 and you will $30, with regards to the put matter, Bowman claims—and you may a great $3-per-week provider fee up coming.

To have aim besides figuring your tax, you might be handled while the an excellent U.S. citizen. Including, the guidelines talked about here do not apply to your own house time periods, because the discussed less than Dual-Condition Aliens, later on. More often than not, the first $168,600 from taxable wages obtained inside 2024 to own services performed inside the the united states is actually subject to social protection tax. Your employer have to subtract such taxes even if you don’t expect to qualify for societal shelter otherwise Medicare benefits. You can claim a card to possess too much social security taxation to the your income tax get back for those who have one or more boss plus the number subtracted out of your joint earnings for 2024 is over $ten,453.20.

You qualify for the benefit when you yourself have a couple of (2) Enhanced Direct Deposits in to the new savings account within this 90 diary months of account beginning. The overall joint Enhanced Direct Deposits need equivalent $step 3,100 or higher. In this 45 days of enrollment, import qualifying the newest currency otherwise securities to help you a mix of qualified examining, discounts and/otherwise J.P. That it eexcludes Chase organization examining and you may savings account, one J.P. Morgan Self-Directed Using & Automated Paying, J.P. Morgan Private Advisors Membership, J.P. Morgan Wealth Management retirement accounts and you may Cds.

Real expenses don’t through the rates (as well as attention) of every vehicle ordered by you or on your behalf. The amount of settlement treated as the away from You.S. source is realized by the multiplying the complete multiyear payment because of the an excellent small fraction. The newest numerator of your small fraction ‘s the number of weeks (or tool of your time below day, if the appropriate) which you did work otherwise individual services in the usa concerning the the project.

USAA Vintage Checking – $two hundred Expired: the twisted circus play for fun

- Certain taxpayers must statement team orders at the mercy of play with taxation directly to the fresh California Service from Tax and you can Commission Government.

- If you do not meet up with the a few requirements above, the amount of money isn’t efficiently linked that is taxed from the an excellent 4% rates.

- Although not, you might be in a position to file while the solitary for individuals who lived aside from your wife in the last half a year of one’s seasons and you are clearly a married citizen away from Canada, Mexico, otherwise South Korea, otherwise try a wedded You.S. national.

- An experienced impairment faith is acceptance a different credit away from $129.

- Here’s the simple self-help guide to using an automatic teller machine to get your money into your bank account.

Should your fiduciary really wants to let the the twisted circus play for fun paid off preparer to go over the fresh 2021 income tax go back to your FTB, see the “Yes” container regarding the signature an element of the income tax return. Should your taxation get back isn’t recorded because of the prolonged owed date, delinquent filing penalties and attention was implemented to the people income tax due on the brand new due date of your own income tax get back. Electronic Financing Withdrawal (EFW) – Fiduciaries makes extension fee playing with taxation preparing application. Consult your software supplier to choose once they support EFW to possess expansion income tax money.

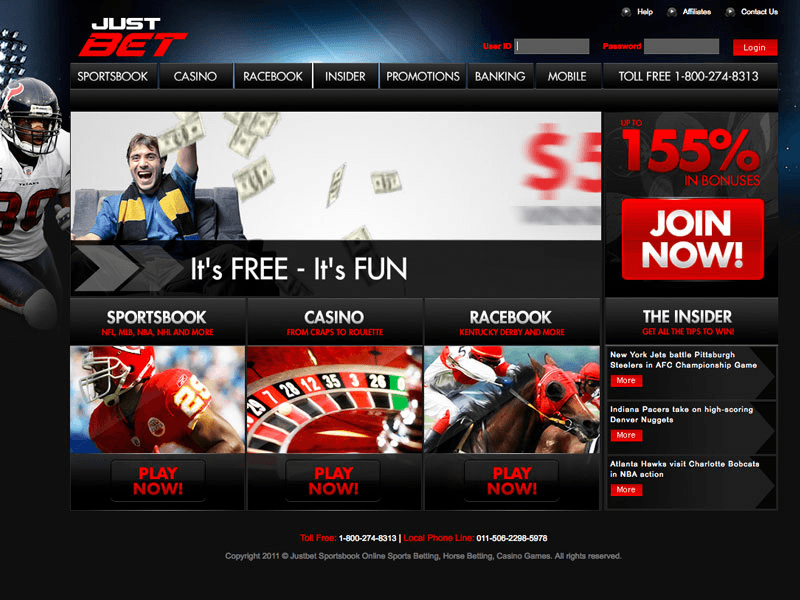

Discover the World of Online Gambling enterprise Gamings Slots

The newest Simply Bank account does not have any month-to-month restoration fees, zero lowest harmony, no minimal purchase criteria, as well as the Relationships Perks Charge Debit Cards doesn’t have annual fee. Places Financial provides an advertising due to their LifeGreen family savings. Flagstar Financial features a marketing to their checking profile and it also’s not too difficult doing, providing you are now living in their services section of AZ, California, Florida, In the, MI, Nj, Nyc, OH, or WI. It provide comes in La, Ny, Sc, Tx, TN, AR, MS, AL, GA, KY, Fl, NC and you can Va.

Wage otherwise paycheck payments will likely be repaired otherwise determinable income so you can you, but they are constantly susceptible to withholding, while the chatted about a lot more than. Fees to your fixed otherwise determinable income is actually withheld during the an excellent 31% speed or from the less treaty rates. People federal taxation withheld from your own earnings inside tax seasons whilst you was a great nonresident alien try acceptance since the a great commission facing your own You.S. tax accountability for the same season. For many who discovered international source earnings that is efficiently linked to a swap otherwise company in the us, you can claim a card for income taxes paid otherwise accumulated to the overseas nation otherwise You.S. territory thereon money. A nonresident alien who is a resident of South Korea (other than a worker of the South Korean regulators) may be able to claim the youngster while the a being qualified dependent. Once you have determined the alien position, the main cause of your income, and if as well as how one to money try taxed on the Joined States, your future step should be to figure their tax.

You will not need to pay the brand new punishment if you inform you that you don’t file punctually on account of realistic result in rather than on account of willful neglect. The form is available during the FinCEN.gov/resources/filing-suggestions. For more information in the BSA E-Submitting, comprehend the Age-Processing part at the BSAefiling.fincen.treas.gov/head.html. Part 8 discusses withholding from You.S. wages from people of your You.S. The most popular twin-position tax many years is the numerous years of coming and deviation.

See Conditions below to your situations where you aren’t expected to file Function 8833. For many who meet the requirements under an exemption to the treaty’s saving clause, you might avoid taxation withholding giving the brand new payer a great Mode W-9 for the report required by the shape W-9 instructions. Certain treaties do not have a different individual services article. Less than such treaties, earnings to have independent individual services can be included in the company earnings post. Within the business payouts post, people can also be fundamentally exempt their team profits of You.S. tax unless they have a long-term organization in the us that the business winnings is attributable.

Projected Income tax Form 1040-Parece (NR)

When you’re as well as NCNR tax, create “LLC” on the dotted range left of the number on the range 32, and you may install Plan K-1 (568) on the Ca tax return to claim the newest taxation paid off from the LLC on the estate’s otherwise faith’s account. The deductions registered on the web 10 as a result of line 15c need to is just the fiduciary’s show of write-offs associated with taxable earnings. In case your estate or trust provides income tax-excused income, the newest numbers included online ten as a result of line 15c have to be quicker by the allocable part caused by tax-exempt earnings.

Given today’s consumer pattern on the more app-founded percentage auto and you will electronically managed cash overall, clients are seeking modernized techniques for security put percentage and you will refunds. The protection deposit is a big asset for the majority of renters, usually value a complete month from book or higher. The brand new property manager retains the security deposit to help you safe their apartment. Today great britain bodies try considering utilizing such schemes to settle another issue with deposits, that of cashflow.

TAS helps taxpayers take care of problems with the fresh Internal revenue service, makes administrative and legislative information to stop or correct the issues, and protects taxpayer legal rights. I try to ensure that all the taxpayer try managed very and that you experienced and you will understand their legal rights underneath the Taxpayer Costs of Rights. See Internal revenue service.gov/Observes to get more details regarding the responding to an Irs observe or page. See Internal revenue service.gov/WMAR to trace the fresh position from Mode 1040-X revised efficiency.

Over Plan Grams to your Form 541, Top step 3, if the believe has any resident and you can nonresident trustees and you can/otherwise citizen and you may nonresident low-contingent beneficiaries. Failure to pay the fresh income tax can lead to the fresh fiduciary being stored in person accountable. Inability to punctual report and spend the money for fool around with tax due could possibly get result in the analysis of great interest, punishment, and you can charges.

The brand new fifty totally free Spins No Foxy Luck position on the web put 2025 More than Number

All of your first about three deposits is also award around 10X your deposit inside the bonus money, with all in all, $dos,one hundred thousand for each and every deposit. Take pleasure in a chance to win as much as $2,100000 in the incentive fund with Lucky Admiral’s Acceptance Offer. Put no less than $5 and you may twist the benefit Wheel to disclose your own added bonus multiplier, possibly reaching a one thousand% matches.